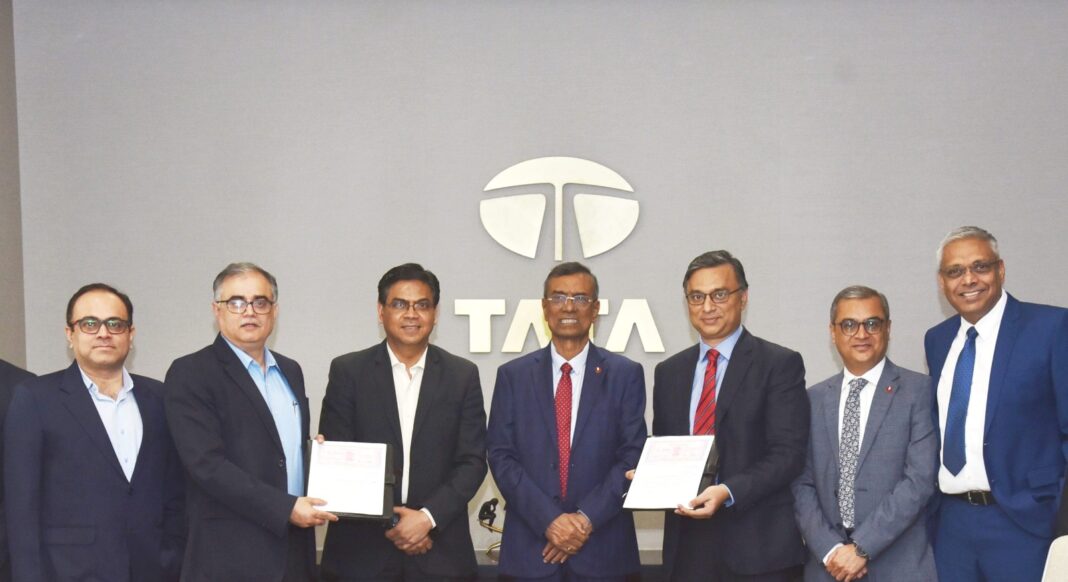

Bandhan Bank, one of India’s fastest-growing private sector banks, has signed a Memorandum of Understanding (MoU) with Tata Motors, to offer convenient financing solutions to its commercial vehicle customers. Under this collaboration, Bandhan Bank will offer financing across the entire commercial vehicle portfolio and customers will benefit from the bank’s wide network and specially curated easy repayment plans.

Speaking on this announcement, Mr. Santosh Nair, Head, Consumer Lending & Mortgages, Bandhan Bank, said, “Bandhan Bank is pleased to partner with Tata Motors to offer seamless vehicle financing solutions. This association reflects our dedication to serving the diverse financial needs of commercial vehicle customers. We are confident that this collaboration will enable us to extend our reach and provide tailored financing options to support the growth of businesses in the commercial vehicle segment.”

Commenting on this partnership, Mr. Rajesh Kaul, Vice President & Business Head – Trucks, Tata Motors, said, “We are delighted to announce our partnership with Bandhan Bank through this MoU, which represents a major milestone in our commitment to providing seamless financing solutions to our customers. This partnership reflects our commitment to providing accessible and efficient financial solutions, empowering our customers to achieve their business goals with ease. Together, we look forward to driving greater convenience and support for our valued commercial vehicle customers.”

Tata Motors offers extensive range of sub 1-tonne to 55-tonne cargo vehicles and 10-seater to 51-seater mass mobility solutions, ranging in small commercial vehicles and pickups, trucks and buses segments to address the evolving needs of logistics and mass mobility segments. The company ensures unparalleled quality and service commitment through its extensive network of 2500+ touchpoints, manned by trained specialists and backed by easy access to Tata Genuine Parts.

Bandhan Bank has steadily grown and will continue to grow its portfolio in verticals like SME Loans, Gold Loans, Personal Loans and Auto Loans, among other product ranges. The Bank had also recently launched new verticals like Commercial Vehicle lending and Loan against Property for businesses.